Welcome to the world of

8 hours, 4 weeks, one goal - Be a financially literate teen!

Register NowLearning Outcomes

Money Smart

Analytical Thinker

10X Future Ready

Session BreakDown

1

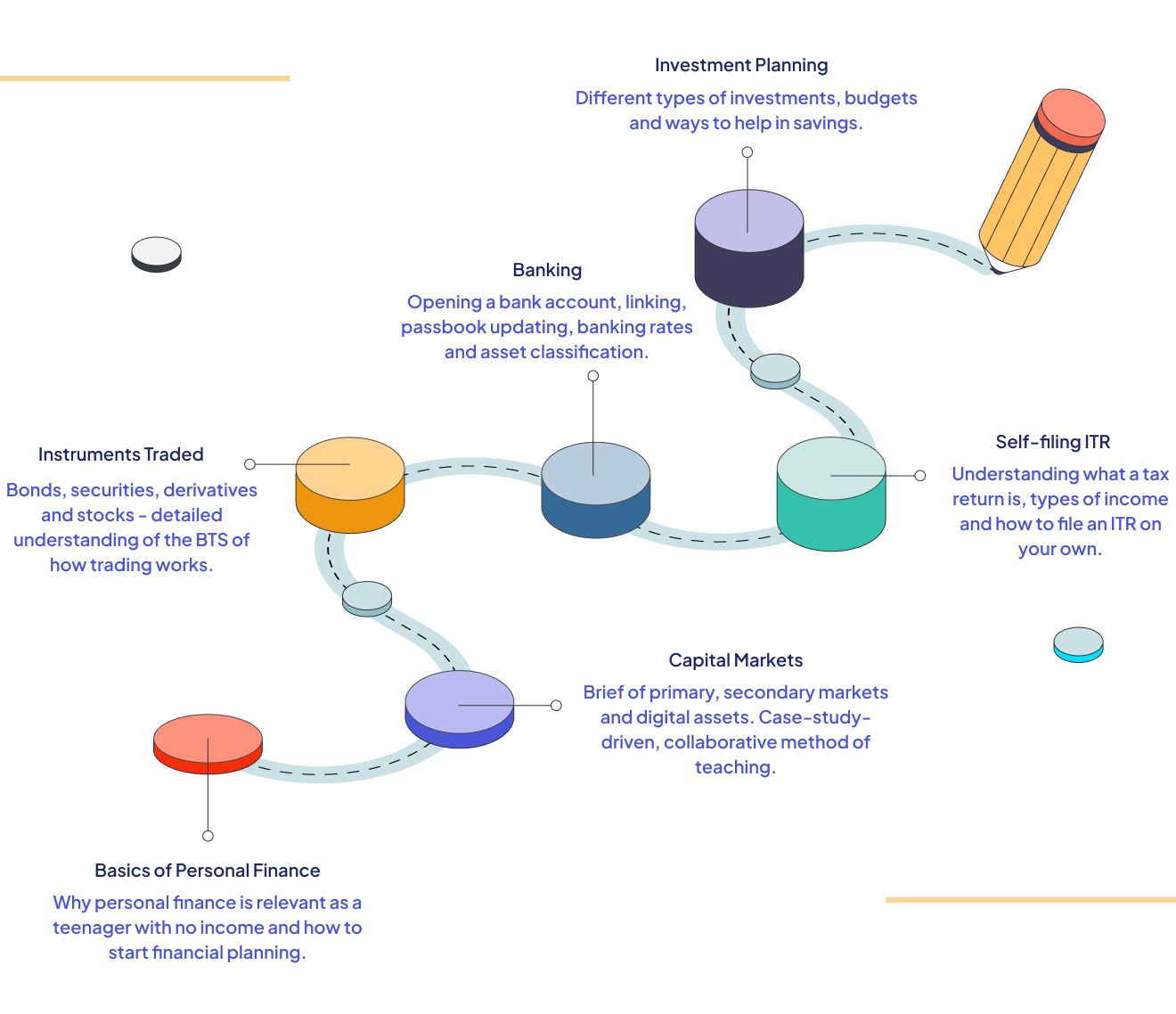

Foundation BuildingIntroduction to preparing a financial statement of a person and step-by-step process of financial planning

2

Types of MarketsHow small businesses grow and raise money, role of SEBI and regulations followed by investors.

3

Trading InstrumentsBrief overview of shares, debentures, bonds, debt instruments and secured assets.

4

Banking for Personal UseHow to open a joint account, updating passbook, e-banking and asset classification.

5

Income Tax BasicsBrief dive into types of income, role of exemptions and deductions. Knowing how you are taxed

6

Income Tax Return & MoreFiling ITR and understanding the GST components that are levied on a day to day basis.

7

Budget and SavingHow to save with little money and how to budget. Creating a monthly budget in the session with emergency fund.

8

Investment OptionsSIPs, mutual funds, digital assets and how to start focusing on building wealth and equity for the future.

FAQs

Bringing Out The Genius In You

Being money smart helps a kid in the present and future. Personal finance is a basic need which aids in the future revolution of jobs.

Yes, optimum results have been observed with teenagers.

No, what you pay in the course is the only investment.

Maximum of 8-10 students only.

Two hours a week, flexible slots available.

Yes, you can! We promise what we can deliver, this is a fun way to start your journey in finance.

Explore financial certifications that are globally recognised and can be completed in a year after school.

Yes, we will provide a certificate.